Advanced Fraud Schemes Require Advanced Fraud Prevention Solutions for Dealers

95% say the increase in identity fraud is directly related to the increase in the digitization of the deal and remote buying experiences, with 86% saying that as more of the transaction moves online, identity fraud will increase and become harder to prevent

95%

Of Dealers Believe

an Increase of

Digitized Transactions

Leads to Increased

Identity Fraud

Top Fraud Challenges at Dealerships

As car buying experiences become more digitized (i.e., DR platforms, digitization of loan applications, approvals and transactions, etc.), a wide range of opportunities have opened up for fraudsters to take advantage of car dealers. Dealers reported identity (stolen or fabricated) fraud as the top fraud challenge at their dealership.

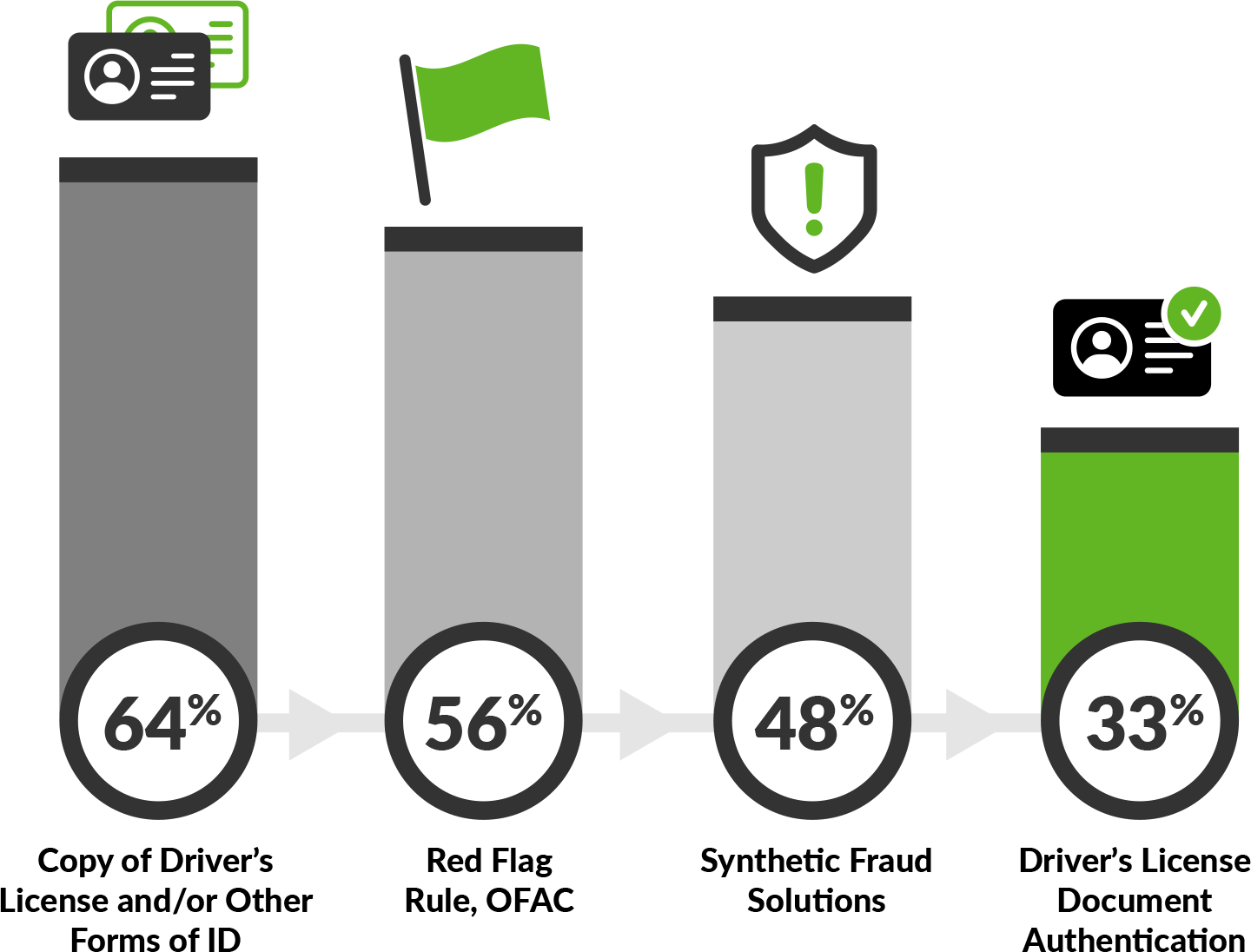

How Dealers Protect Themselves From Identity Fraud

As fraud schemes become increasingly difficult to detect and prevent, the need for advanced fraud prevention solutions grows. When dealers were asked how they protect themselves from identity fraud risks, Only 33% cited the use of any ID verification technology as part of their fraud prevention strategy. Dealerships who exclusively use these unsophisticated, compliance-driven fraud prevention controls are putting themselves at risk and making their business an easy target for fraudsters.

How You Can Improve: Know Your Customer (KYC) Verifications

The sophistication of identity fraud scams has increased dramatically, driving the need for advanced identity proofing solutions. Simply put, photocopying ID’s and manually verifying identities is too slow and too inaccurate to rely on. The right technology reduces customer frictions and is both faster and more accurate than the best-optimized manual methods.

An effective identity fraud defense strategy demands a multi-layered approach:

Pulling credit prior to the test drive or first pencil can uncover suspicious credit characteristics that may warrant additional due diligence:

Everybody Wants to Be More Efficient and Save Time, Including Dealers

Fraud challenges are making it increasingly difficult for dealerships to validate consumer identity, vet their creditworthiness and provide the best user experience possible without sacrificing any of the essential protections. Identity solutions exist that can convert a DL scan into a consumer pre-qualification – creating a safer, more efficient, faster moving sales and finance deal flow. 93% of dealer respondents agreed.

Risk Free Buying and Selling

As part of a digital-first, credit-first buying experience, integrating identity verification and digital credit solutions can create meaningful benefits:

- Authentication technology and purified information eliminates identity and financial fraud risks.

- Honest and transparent payment quoting accelerates engagement and improves closing ratios.

- Knowing the customer's buying power upfront and putting the customer in the right car and the right deal structure increases PVR.

Conclusion

Like many challenges facing the car buying market, the problem of fraud will never go away. Dealers relying exclusively on unsophisticated fraud prevention tactics are most at risk.

The solution to massive increases in identity fraud is not to pull back from the Digital Retailing that amplified it, but to embrace new technologies and automated processes that can prevent it. The most effective fraud protection strategy should be a combination of technology and documented identity theft prevention program (Red Flags Rule) that works together to protect the dealership business and their customers.

www.elendsolutions.com | All Rights Reserved.