Fraud In Retail Automotive Is Already a Big Problem and Continues to Grow – Costing Dealers Millions

Identify Fraud Is Surging

It is no surprise that the majority of dealerships (88%) acknowledge that the auto retail industry has seen an increase in identity (stolen or fabricated) fraud since the start of the pandemic. But, more surprising, is that a whopping 84% of respondents have directly experienced identity fraud at their dealership since then.

Since the pandemic...

Of Dealers Believe There Is Increased Fraud in the Automotive Industry

Of Dealers Saw Increased Fraud at Their Dealership

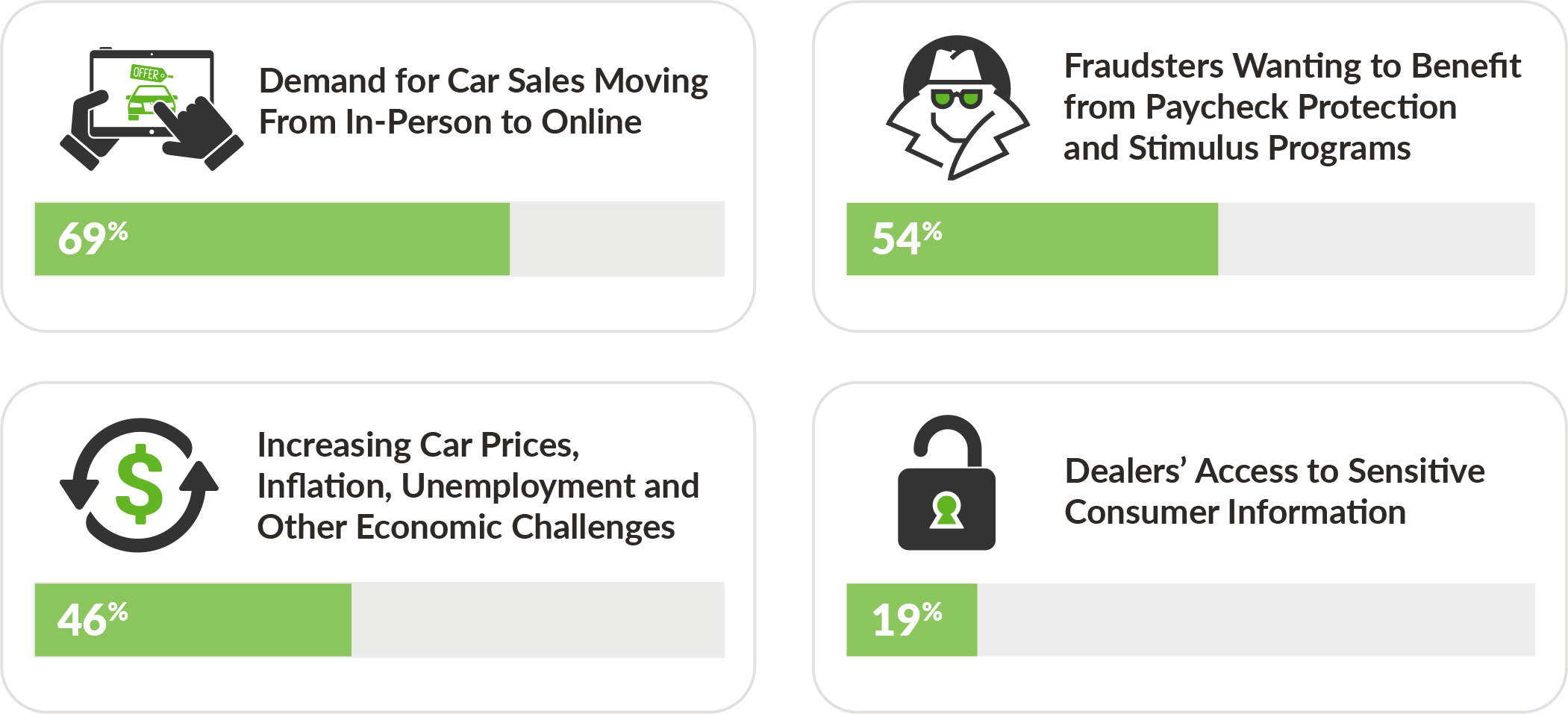

What Do You Think Has Contributed to That Increase?

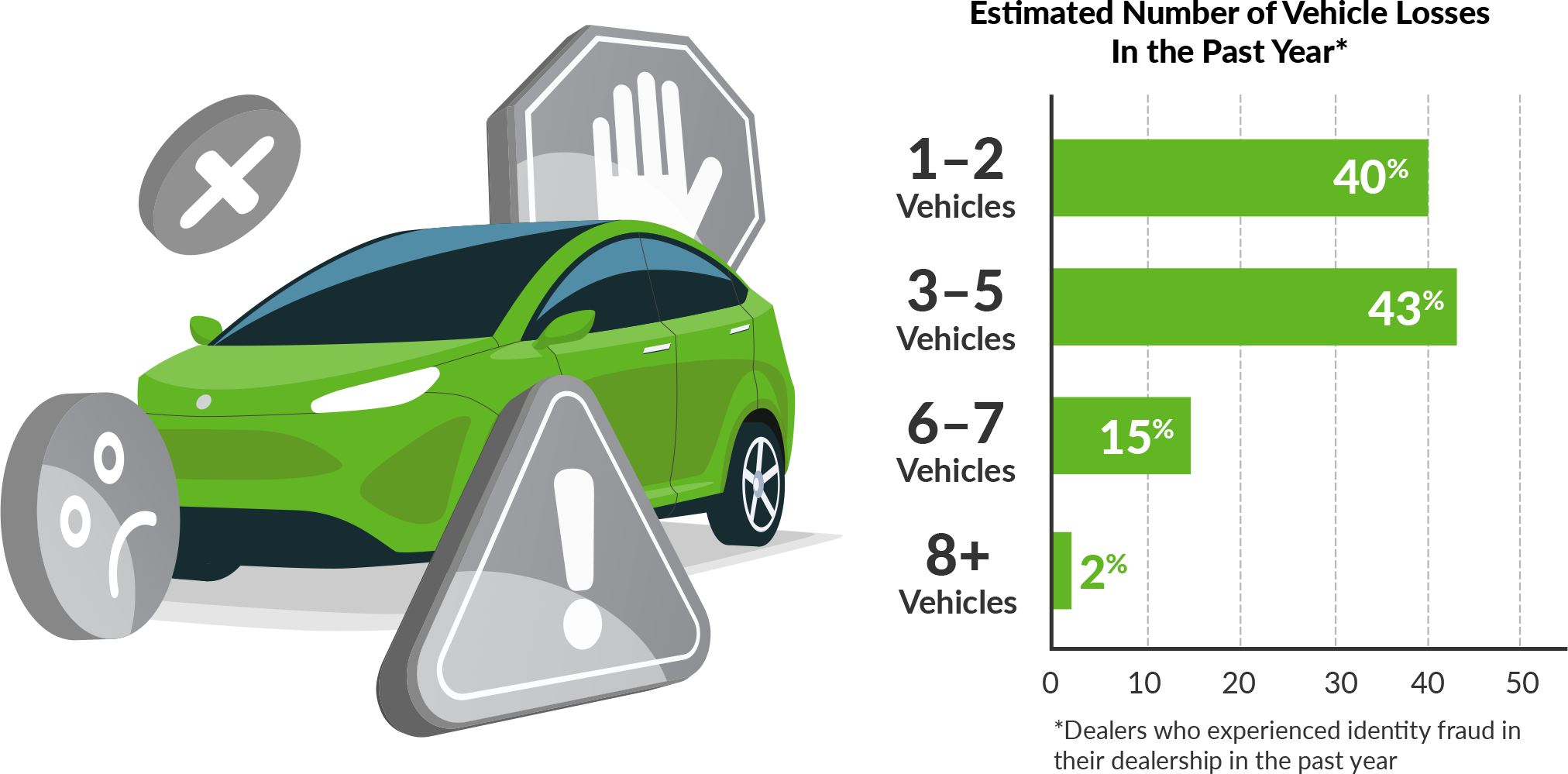

In The Past Year, Nearly Half (47%) of Reporting Dealers Lost Three or More Vehicles

Seventy-nine percent of dealers surveyed experienced an identity fraud-related vehicle loss in the last year. Forty percent of those reported a loss of one to two vehicles; but, even more alarming, 60% reported a loss of three or more vehicles.

Over half a BILLION in identity fraud-related vehicle losses at new car dealerships is predicted for 2022 - and that is a conservative estimate!

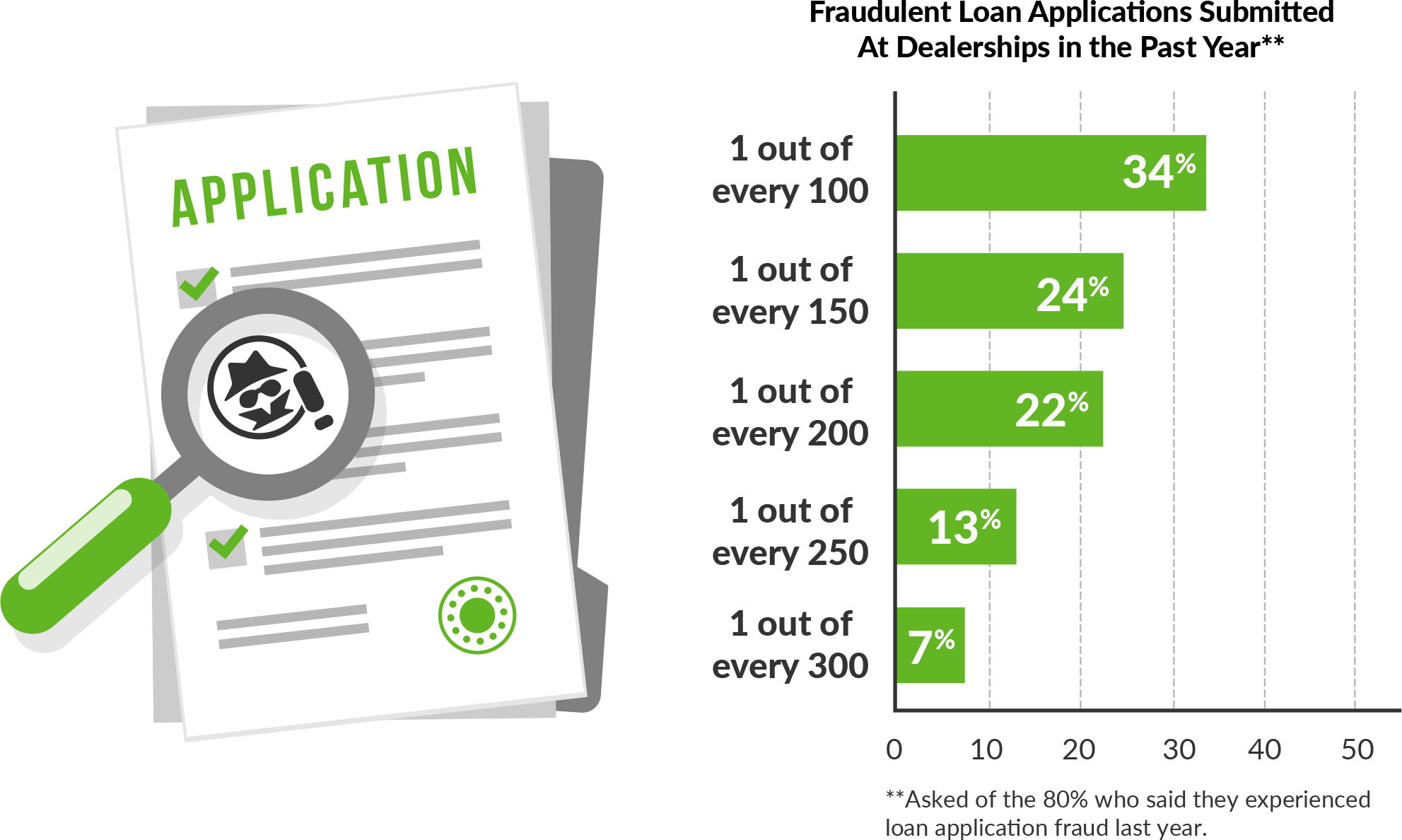

Fraud Comes In Many Forms – Loan Applications!

Loan application misrepresentations — such as employment fabrication, income manipulation, true name fraud or straw borrower manipulations — are a growing threat. Of the 89% of dealers who reported an increase in loan application fraud in the past year, 77% saw a 10 – 20% increase or more, with over one-third reporting that one in every 100 applications at their dealership was fraudulent.

Conclusion

The massive DR disconnect between saying DR works and actually embracing it continues.... Until auto dealers have access to, and the will, to fully embrace, tools and processes that are able to solve information disconnect from online to instore, it is unlikely that the time spent in the dealership is going to improve any time soon.

www.elendsolutions.com | All Rights Reserved.