Transform the Transaction: The Power Duo of Pre-Desking and Automotive Desking Software

If you’ve been in this business for a while, you’ve seen firsthand how the buying process has changed. Gone are the days when dealerships controlled every step of the transaction. Today’s customers arrive more informed than ever, expecting speed, accuracy, and transparency.

The challenge? While customer expectations have evolved, many dealership workflows and tools have not. Outdated processes create friction, slow down deals, and impact profitability.

That’s where advanced pre-desking tools and automotive desking software come in. These solutions work together to streamline deal structuring, eliminate inefficiencies, and ensure every deal is fundable and optimized for profitability before reaching F&I.

In this article

- 1 Why Speed, Accuracy, and Transparency Are Non-Negotiable in Automotive Retail

- 2 Understanding the Tools: Advanced Pre-Desking vs. Automotive Desking Software

- 3 Integration Workflow: How the Tools Work Together

- 4 Game-Changing Benefits of Pre-Desking and Automotive Desking Software

- 5 Transforming The Transaction: Best Practices for a More Profitable Workflow

Why Speed, Accuracy, and Transparency Are Non-Negotiable in Automotive Retail

Think about the last time you visited a restaurant or retail store. If the service was slow or the pricing was unclear, how likely would you be to return? The same applies to car buyers. The vehicle may be the star of the purchase, but the experience determines satisfaction and profit potential.

Speed Matters More Than Ever

Today’s car buyers expect efficiency and transparency. They’ve done their research, narrowed their choices, and when they arrive at your dealership, they want help completing the purchase—not starting over. Whether online or in-store, they expect clear, straightforward numbers and a process that moves at their pace. Here’s how deal structuring impacts that experience:

Traditional Approach

John walks into your dealership, already on a car, pre-approved and ready to buy. The desk works the first pencil, but the payment estimate is based on a credit score range and educated guesswork, not real lender-matched terms. As the negotiation progresses, the back and forth starts. Numbers shift, lender conditions require reworking, and the process slows down. By the time the deal is structured and submitted, the lender counters, forcing another round of adjustments. The result? Delays, frustration, and unnecessary frictions.

A More Efficient Workflow

Now, imagine John walks in and reviews real, lender-approved payment options tailored to his vehicle of choice and credit profile. The desk refines the deal within structured, fundable parameters—no rate guessing, no unnecessary back-and-forth. The deal moves efficiently through the process, allowing F&I to focus on value-added product sales rather than fixing last-minute issues.

Accuracy Builds Trust

Few things frustrate car buyers more than negotiated payments that don’t match the final deal. When online payment tools provide unrealistic ‘estimates’ or leave out key details—like taxes, dealer fees, or lender stipulations—customers feel caught off guard when the numbers change in F&I. And the more a deal shifts, the harder it is to close.

Setting the right expectations from the start is critical. By providing lender-approved, fundable payment scenarios early in the process, you create consistency between what’s quoted and what’s signed. This reduces friction, builds buyer confidence, and makes for a smoother deal flow—without the last-minute surprises that derail customer satisfaction.

Seamless Deal Structuring Starts Here

Speed, accuracy, and transparency aren’t just customer expectations—they’re the foundation of efficient and profitable deal structuring. The key is ensuring early finance scenarios are aligned with lender underwriting requirements, so the entire process—from the first pencil to final lender submission—flows smoothly.

Next, we’ll take a closer look at how advanced pre-desking and automotive desking software work together to create a more streamlined, predictable, and profitable deal flow

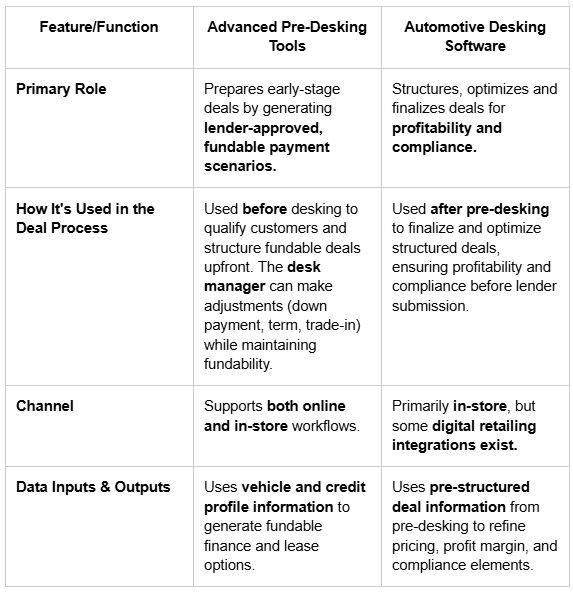

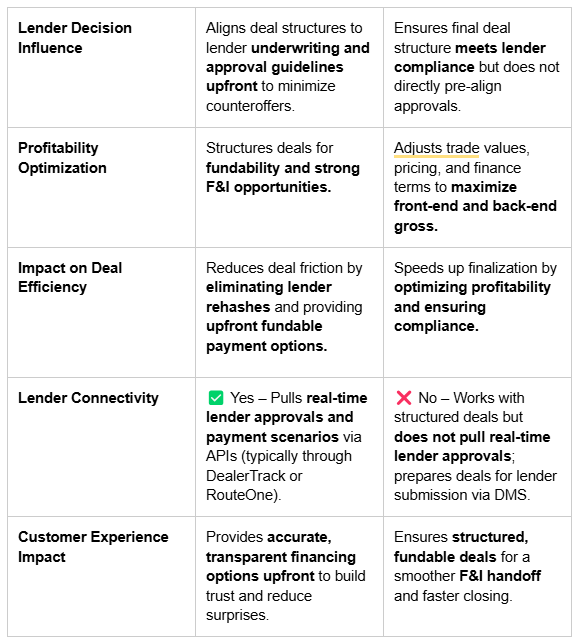

Understanding the Tools: Advanced Pre-Desking vs. Automotive Desking Software

Every dealership uses desking software—but does it actually structure deals, or just refine them? And where does pre-desking fit in? Understanding the role of each tool is critical to structuring faster, more profitable, lender-approved deals.

Pre-desking tools handle the heavy lifting upfront—matching the credit-qualified buyer with lender-approved payments options that include taxes, fees, and incentives down to the VIN and rooftop level. By the time the deal hits the desking tool, it’s already structured, so the focus shifts to profitability, compliance, and F&I.

Core Functions Pre-Desking Tools

- Lender Matched Payments Upfront : These tools utilize advanced credit filtering and calculation logic to match the vehicle of choice and customers credit profile to real, fundable finance and lease options – before the first pencil.

- No Payment Guesswork: Calculates lender-qualified funding scenarios that include all incentives, taxes, and fees down to the VIN and rooftop level.

- Dynamic Deal Structuring: Adjusts rates, terms, and lender stipulations in real time, ensuring that every deal meets underwriting and loan advance guidelines before it reaches the desk.

✅ Pre-Desking Output: A near-final, lender-approved deal structure ready to be optimized in desking.

Core Functions of Automotive Desking Software:

- Profit Optimization: Adjusts trade values, vehicle pricing, and finance terms to protect gross and improve front-end and back-end profitability.

- Compliance & Funding Alignment: Ensures deals meet all lender stipulations, state laws, and regulatory requirements.

- DMS Integration & Finalization: Passes finalized deals to DealerTrack or RouteOne for lender submission and to F&I for contracting and product sales

✅ Desking Software Output: A finalized deal optimized for profitability, ready for F&I and lender submission.

Now that we’ve broken down how pre-desking and desking tools work together, let’s compare their distinct roles side by side.

Comparison Table: Pre-Desking Tools vs. Automotive Desking Software

Integration Workflow: How the Tools Work Together

Every desk manager knows the pain of deal friction—the back-and-forth, the lender surprises, the wasted time in F&I. When automotive pre-desking tools and desking software tools work together, those roadblocks disappear. Every dealership has their own processes and workflows but here’s how a smooth workflow should look in today’s dealership

Step 1: Customer Inquiry and Pre-Desking Preparation

- The customer submits financial details (credit app, income, employment, residential history) online or in-store.

- The pre-desking tool instantly matches the vehicle and customer credit profile to lender programs, generating, fundable lease and retail payment options that include all taxes, fees, and OEM incentives

How It Plays Out in the Dealership

A customer walks in after applying online. Instead of starting from scratch, your team already has lender-approved payment options tailored to their credit profile and the exact vehicle they want. No more first-pencil guesswork—just real, fundable deals ready to go.

Step 2: Passing Data to Desking

- The pre-desking tool sends lender-approved finance scenarios (payment, rate, term, lender stipulations) directly into the desking tool via API or DMS integration

- The desk manager sees ready-to-go, fundable deal structures—no manual data entry, no errors.

How It Plays Out in the Dealership

Instead of making a best-guess pencil, your desk manager has the exact fundable payment options upfront. No need to estimate rates, taxes, or lender stipulations—the deal is already compliant and ready to desk.

Step 3: Customer Selects a Preferred Scenario

- The customer chooses from real, fundable payment options—no estimates, no rehashes.

- If adjustments are needed (trade-in value, down payment, lender conditions), the sales team updates terms in the pre-desking tool, keeping everything lender-compliant in real time.

How It Plays Out in the Dealership

The customer selects their lender-approved payment option but wants to adjust their down payment. Instead of the salesperson running back and forth, the desk manager updates the pre-desking tool instantly, ensuring the new terms remain lender-compliant. This keeps the deal fundable and moves negotiations forward without delay..

Step 4: Refining the Deal

- The negotiated, near-final structure moves to the desking tool, where the desk manager optimizes gross profit, adjusts trade values, and ensures lender reserve opportunities.

How It Plays Out in the Dealership

Instead of waiting until F&I to introduce protection products, your team begins positioning extended warranties and GAP coverage as part of the payment conversation in the desking phase. This allows the customer to see how these products fit into their monthly payment before transitioning to F&I, setting the stage for a smoother final presentation.

Step 5: Final Lender Submission

- The finalized deal is sent via DealerTrack or RouteOne for lender approval.

- If the pre-desking tool handles lender submission, the deal moves even faster—no delays, no surprises.

How It Plays Out in the Dealership

Instead of submitting deals with uncertainty, your team already knows the deal structure aligns with lender guidelines before it even reaches final approval. Pre-desking tools ensure fundability upfront, reducing lender rejections and minimizing back-end rewrites. While lenders may still require stipulations or verifications, the process moves faster and with fewer unexpected hurdles—keeping deals on track for quicker funding.

Step 6: F&I Handoff

- With lender approval secured, the customer is transitioned to F&I for contracting.

- Since the lender-approved terms are already locked in, F&I isn’t stuck fixing desking mistakes—it’s laser-focused on selling high-margin protection products, improving finance penetration, and boosting PVR.

How It Plays Out in the Dealership

With lender-approved terms in place, the F&I manager can focus on presenting protection products instead of restructuring deals. Instead of spending valuable time correcting rate discrepancies or adjusting deal terms due to lender rejections, F&I starts each conversation with confidence—knowing the deal is structured for approval. While final lender verifications may still apply, the process flows smoother, improving finance penetration, PVR, and the overall customer experience

Game-Changing Benefits of Pre-Desking and Automotive Desking Software

In today’s fast-paced automotive market, deal frictions aren’t just frustrating—they directly impact profitability. Rate guessing, lender rehashing, and prolonged negotiations slow deal flow and erode gross. Leading dealerships are leveraging pre-desking and desking tools to streamline workflows, improve lender relationships, and drive stronger financial outcomes.

How Pre-Desking and Desking Work Together to Streamline Deals

A structured deal process eliminates roadblocks that slow negotiations and delay funding:

- Pre-desking tools structure deals upfront using real-time lender-approved, fundable payment scenarios, ensuring payment accuracy and reducing reworks.

- Desk managers make lender-compliant adjustments to maintain fundability throughout negotiations, eliminating last-minute surprises.

- Once the customer selects a financing scenario, the deal moves into desking for final profit optimization, compliance validation, and lender submission.

This approach keeps negotiations focused on customer preferences—not fixing deal structures or chasing lender approvals.

Key Benefits of a More Efficient, Lender-Friendly Deal Process

✅ Build Trust with Transparency: Customers feel confident when they see lender-approved, fundable payment options upfront, leading to smoother negotiations and higher close rates.

✅ Accelerate the Sales Process: Eliminating rate guessing and lender rehashing means deals move from the first pencil to finalization faster, reducing negotiation friction and keeping customers engaged.

✅ Strengthen Dealer-Lender Relationships: Upfront lender-matched finance scenarios reduce counteroffers and speed up funding. Pre-desking tools align deals with lender criteria before desking finalizes them—leading to smoother approvals, fewer reworks, and improved cash flow.

✅ Boost Profitability While Reducing Friction: With pre-desking ensuring compliance and fundability upfront, desking can focus on maximizing front-end and back-end gross without delays from lender restructuring.

✅ Enhance the Customer Experience: Today’s buyers expect speed, accuracy, and clarity. Pre-desking eliminates unnecessary back-and-forths, keeping payment estimates accurate and allowing customers to move through the buying process faster.

Transforming The Transaction: Best Practices for a More Profitable Workflow

The automotive retail landscape is evolving, and dealerships that adapt will stay ahead. The combination of pre-desking and desking tools is more than a process improvement—it’s a strategic advantage.

By prioritizing structured, fundable deals upfront and optimizing profitability before lender submission, dealerships benefit from:

- Fewer lender rehashes and counteroffers

- Higher finance penetration and PVR

- Faster funding and improved cash flow

- More closed deals with higher gross

Now is the time to evaluate whether your current process is maximizing its potential—or if it’s holding your dealership back from the next level of profitability.