Revolutionizing the Car Buying Experience: Eliminate Finance Frictions

The automobile retail industry finds itself at an important intersection, where information disparities and the siloed deal flow add frictions – creating the foundation for a less-than-ideal car buying experience. In Part 1 of this two-part blog series, we unpacked the paradox of AI-driven pricing and its impact on transparency and the transaction.

In this blog, also informed with insights from dealers and lenders*, we uncover the truth behind payment quoting tools and their effects on the car buying experience. It sheds light on industry wide accuracy challenges and complexities related to arriving at the “deal”, revealing a reliance on consumer self-penciling tools and “penny perfect” illusions far from reality.

The silver lining? Overlapping the start of sales and finance activities, combined with emerging pre-desking technology stands ready to address these issues, paving the way for a new era of increased efficiency and profitability for dealers and lenders alike.

In this article

The Challenges: Information Deficits & Old School Workflows

1. The Flawed Foundation of Online Quotes

Adopting digital retailing solutions is one way many dealers are attempting to meet buyer demands for more buying conveniences. Oftentimes these solutions include basic payment calculator or ‘self-penciling’ tools, giving the consumer the sense of not only being in control, but also offering the promise of saving time at the dealership.

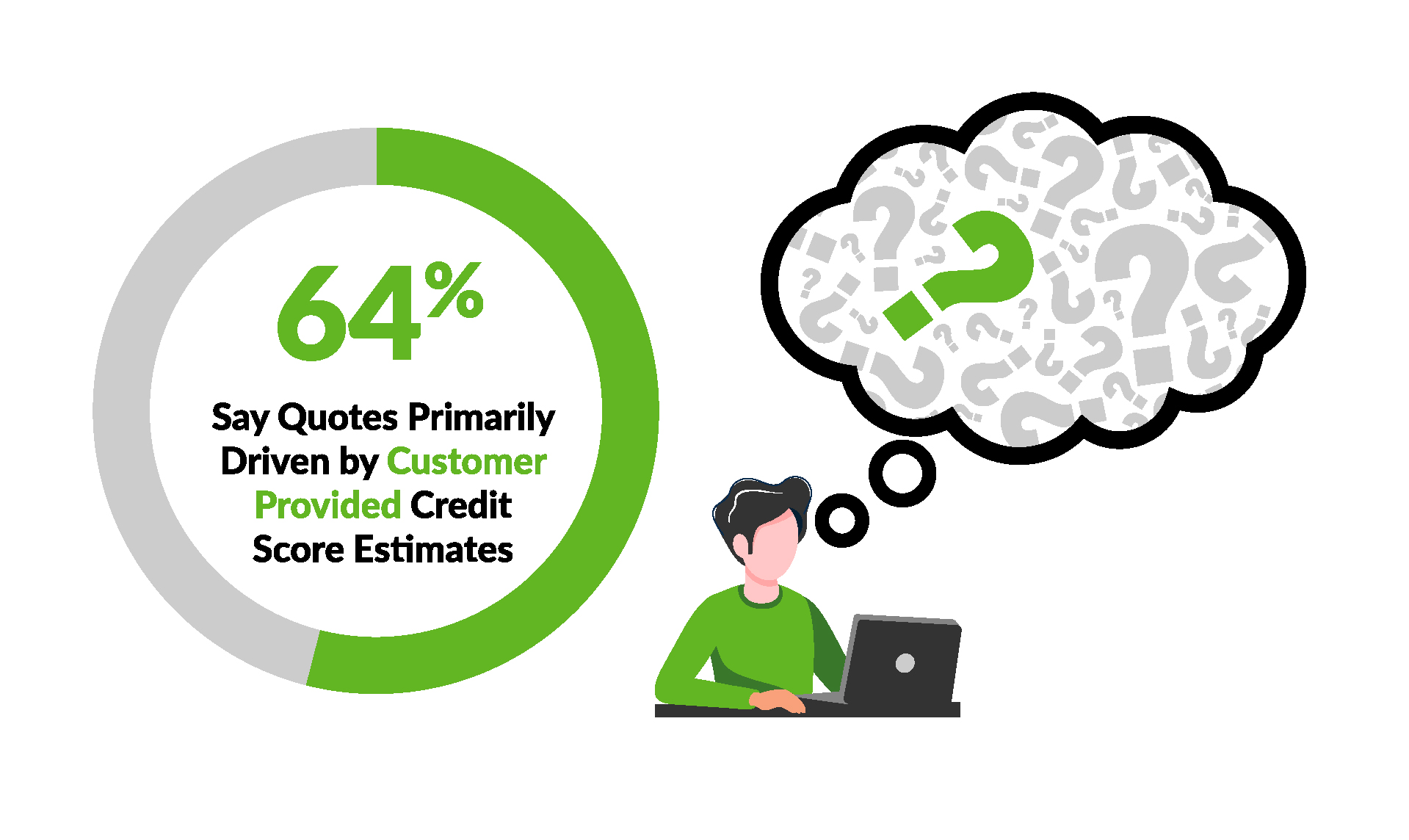

The disconnect? Today’s online quotes often rest on shaky foundations, with 64% of responding dealers agreeing that online payment quote estimates are often based on consumer-submitted credit information , rather than actual FICO scores or lender-decisioning criteria.

In fairness to your buyer, the majority of customers provide accurate credit score estimates – to the best of their ability – when using self-penciling payment calculator tools. However, while the credit score is a crucial factor in determining financing terms, it is only one of many criteria used by lenders and not nearly enough to determine credit eligibility and loan pricing. The idea of quoting a payment based on a single ‘estimated’ credit attribute is almost silly. As is this hypothetical comparison.

The point here is not all customers qualify equally – not to the same rate, term and payment. A college grad without a job can have a 740 credit score but can’t finance a bicycle, whereas a high income, high net worth, high down payment customer with a lower credit score can get multiple finance offers. Similarly, self-penciling payment tool estimates could be off by as much as $50 to $100+ a month, which is a BIG deal for most shoppers and can amount to thousands of dollars over the life of the loan.

Additionally, most digital retailing payment calculator tools do not include dealer specific fee structures and/or all applicable taxes. Even fewer include selected F&I product sales. And fewer still include any level of dealer participation. These products and fees and taxes can add thousands of dollars to the deal and significantly impact monthly payments. This is not a good car buying experience

The lender is also likely to have specific guidelines regarding the type, age, and condition of the vehicle eligible for financing – all of which will affect the payment. Other criteria used by lenders to qualify the customer and the specific vehicle of choice include:

| Customer Evaluation Factors | Vehicle Evaluation Factors |

| Type of Financing | Lease or Purchase | Programs | OEM programs Incentive rates & rebates Regional rates |

| Programs | OEM programs Incentive rates & rebates Regional rates |

Vehicle Type | New Pre-owned Certified Same Brand |

| Pricing | Credit tier Interest rates Money factors Residuals |

Vehicle | Model Year Trim/Options Mileage |

| Customer Information | Application data Credit report data Identity verification |

Deal Structure | Net Selling Price Trade-in Equity (+/-) Down Payment Accessories F&I Products |

| Underwriting | Credit attributes Ability factors Stability factors |

Advances | Loan to Value Front-end Advance Back-end Advance |

2. Misunderstood “Penny Perfect” Payments

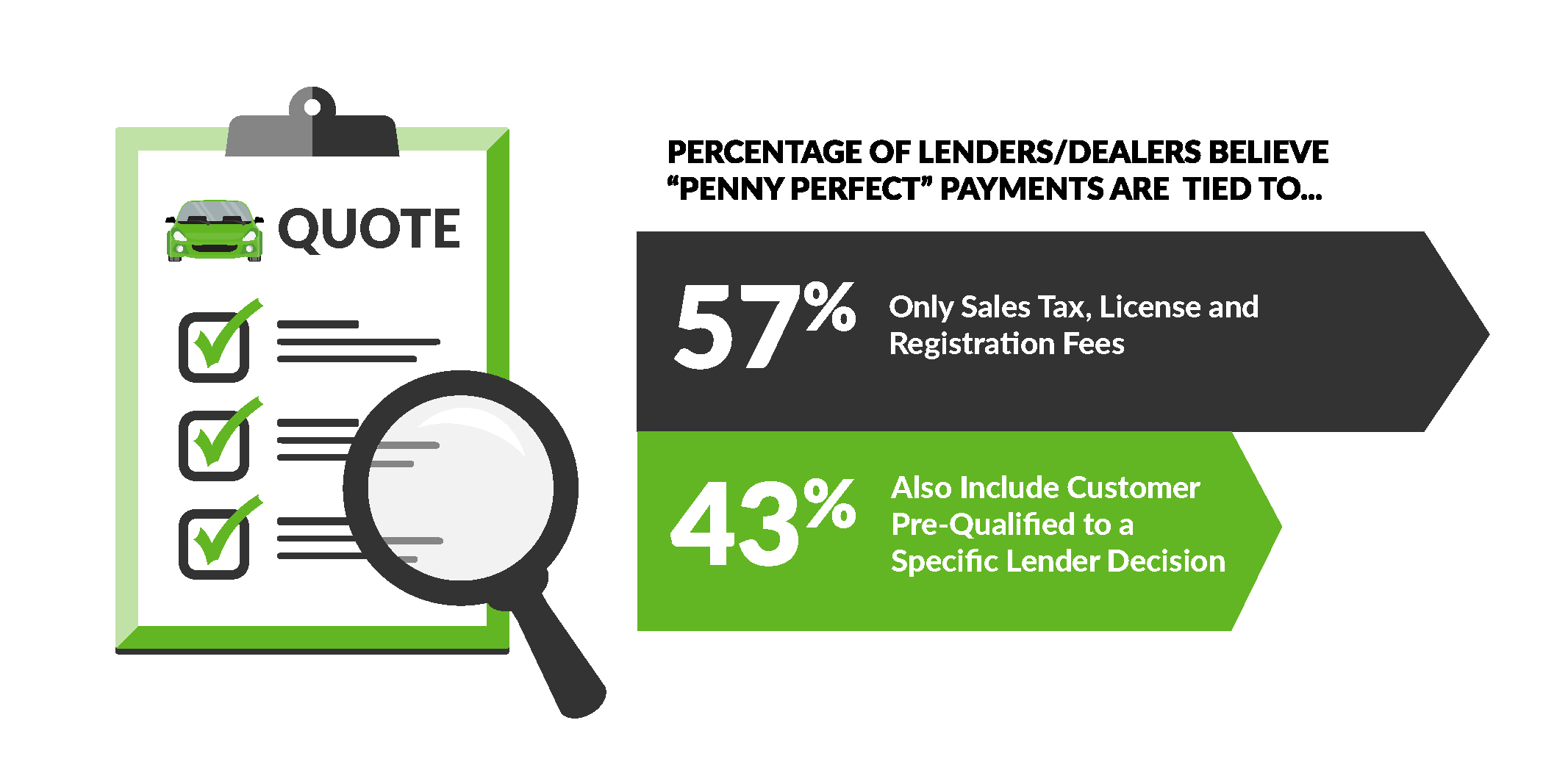

A surprising insight from our dealer survey was the confusion regarding the definition of penny-perfect payments. Spilt almost down the middle, less than half of dealers believe a “penny perfect” payment includes an accurate ‘down to the penny’ payment calculation, the dealers’ specific fees and all applicable taxes – that is also matched to a specific qualified lender decision.

More than half of dealers have a different interpretation of about what qualifies as “penny perfect.” Their interpretation includes a payment estimate that is not consumer qualified or matched to a specific lender decision. The divergence of opinion presents a roadblock to transforming the transaction and improving the car buying experience.

Some may focus strictly on the accuracy of the financial calculations down to the penny, inclusive of all fees and taxes. Others might emphasize the importance of aligning these estimates with customer qualifications and specific lender decisions. This variation in understanding can lead to differing expectations and implementations and customer buying experiences across the industry.

3. Old School Workflows

Compounding the accuracy challenges of digital retailing payment quoting tools and different interpretations of ‘penny perfect’ is the traditional timing of when finance typically gets involved in the deal. Spilt almost evenly, the majority of dealers don’t secure a lender decision until after Sales has four-squared the deal, negotiated the payment and obtained a verbal “yes” from the customer.

This approach, designed by dealers for dealers, can have the unintended consequence of adding frictions to the car buying experience and perpetuating trust challenges when the ‘negotiated’ terms cannot be matched to a qualifying lender program – creating process bottlenecks and other profit leaks when the deal must be re-worked in the F&I office.

The Solution: Changing When and How The Customer Is Introduced to Qualified Finance Information

Early Finance Involvement: A Car Buying Experience Game Changer

There is an opportunity to reverse-engineer this old school workflow and overlap the start of sales and finance activities, digitally or otherwise. As a part of a “credit-first” car buying experience, with early prequalification’s the faster and more profitably the deal can be structured. Quoting accurate, qualified numbers is also a trust multiplier, helping you the dealer and your customer to come together much faster.

A convincing 74% of responding dealers and lenders agree: involving finance early in the deal flow, even before the first pencil, replacing the educated guesswork used by most desk managers, could dramatically enhance the process for all stakeholders.

A Near Unanimous Call For Digital Finance Innovation

An overwhelming 94% consensus among dealers and lenders suggests that the integration of pre-desking technology , leveraging lender-specific credit scorecard models, could revolutionize the car buying and selling experience by filling these critical information gaps.

These new pre-desking technologies, leveraging advanced credit filtering and calculation logic to instantly match your shopper and the vehicle-of-choice to multiple consumer qualified lender programs – enables ‘Real Deal’ terms to be presented to consumers remotely or in-store prior to the first pencil or F&I handoff.

By matching THE deal to the best lender fundable program and eliminating the inefficiencies and redundancies created by poorly structured deals, technology dramatically reduces deal unwinds and rewrites – improving the speed and quality of the customers’ transition to and through finance.

Conclusion: Forging A New Path

The digital finance landscape is fraught with frictions, primarily due to prevalent information gaps and lender non-transparency. However, this challenge presents an opportunity for transforming the car buying experience. Getting accurate payment quotes early in the vehicle purchase that match the final terms of their purchase agreement at the dealership is a reasonable expectation that is not currently being met.

It is the key to unlocking a new standard of efficiency and satisfaction in our industry. Lenders and dealers both have a role. Join us in embracing this next step in the evolution of the car buying experience, steering towards a future where every participant in the transaction benefits from the clarity and precision of early finance integration.

Click here to view Part 1 of this two-part blog series.

*Source: 2024 survey of over 300 auto dealers and lenders across the U.S., fielded by eLEND Solutions