Automotive Digital Retailing: What Dealers Should Know

It’s the excitement of another deal made, funded, and delivered that ends with a sticker beside a salesperson’s name. Making deals and selling cars is what automotive retailers do best, but it is a process built by dealers for dealers that is a significant source of anxiety and dissatisfaction for most car buyers. Over the years, dealers have perfected practices that optimized the opportunity of knowing more. The whole automotive-retail industry grew up believing you control the customer and the deal.

That’s changed dramatically. Today, long before COVID-19, shoppers know every bit as much about the vehicle’s value as the seller does. Empowered, tech savvy, convenience-driven consumers are accustomed to segueing seamlessly from online to off and expect a transparent, more personalized, inclusive shopping experience. The Pandemic accelerated a transformation that forced dealers to sell the way customers have wanted to buy.

The reality is that real Automotive Digital Retailing, including getting to a fundable contract remotely – versus ‘enhanced Lead Gen’ masquerading as automotive digital retailing – has the potential not only to save our industry by creating buying experiences that consumers prefer, but also to accelerate the changes that can ensure a more efficient, more profitable future.

In this article

- 1 What is Digital Retailing?

- 2 What Digital Retailing Is Not

- 3 Future Proof Your Business

- 4 Digital Retailing Benefits Dealers, Not Just Buyers

- 5 Not a Race to the Bottom

- 6 Sell The Car, Not the Appointment

- 7 Why Are Some Dealers Stalling on Automotive Digital Retailing?

- 8 Upsetting The Status Quo Has Its Challenges

- 9 Digital Retailing Roadblocks & Speedbumps

- 10 Creating a Unified Car Buying Experience

- 11 Digital First, Customer First, Credit First

- 12 Credit First vs. Credit Last

- 13 Risk Free Buying & Selling

- 14 Sell the Way Your Customer Wants to Buy

- 15 Transforming the Transaction

What is Digital Retailing?

Digital Retailing is a process that enables a fully integrated, connected buying experience that makes the car buying journey more convenient and less time-consuming for your customers. Automotive digital retailing is a process that enables a fully integrated, connected buying experience.

It makes the car buying journey more convenient and less time-consuming for your customers. Digital retailing refers to the combination of technology, tools and integrated workflows that enables car buyers to complete many steps of the car purchasing process online, and pick up where they left off when they finalize the transaction in person at the dealership.

Digital retailing means making your website more transactional. Think of your website visitors as digital walk-ins. Your virtual showroom is your first chance to make a good first impression because nowadays, that’s where you interact with your customer for the first time.

With automotive digital retailing solutions, making a good first impression includes giving the shopper the tools to complete many or all car buying steps when they want, where they want, and progress at their own pace. You have to ‘win’ with the customer online before you can expect to win in the store.

What Digital Retailing Is Not

It isn’t simply a website: A website with photos of cars and pricing that dead-ends shoppers at lead forms – forcing customers to call or come to the dealership for more information – is lead generation. Automotive digital retailing is a deal generation. It is the start of the deal. It is not enhanced lead generation. Sell the car, not the appointment.

It isn’t simply technology: It’s a process; a culture. Technology takes away the human aspect that customers want in the car-buying journey. And for car dealerships worldwide, it’s common knowledge that it’s people who sell cars, not the tools they have. While technology is an important component of a digital retailing strategy, there’s so much more to it than that.

It isn’t simply e-commerce. There are some automotive retailers that operate as e-commerce businesses like Carvana and Vroom. While they may sell millions of dollars’ worth of cars every month, there’s a reason they haven’t yet made a net profit. Digital retailing can facilitate an end-to-end e-commerce experience, but less than 5% of car buyers want to complete the entire transaction online. The other 95% mostly still prefer to complete some steps of the process – including the test drive and taking delivery – at the dealership.

Automotive Digital Retailing Capabilities

A digital retailing automotive experience should offer a well-designed path-to-purchase that allows car shoppers to self-direct the entire car buying process online. Purchasing a car involves many steps and the exact process can be different for each customer, but the capabilities of your digital retail solution should include (the list below is not meant to be comprehensive):

- Vehicle Search: Let your customers search based on their preferences. Enable advanced browsing based on new/used, type, make, model, year, age, price, payment and more.

- Shopping Cart: Allow consumers to select cars and save them for consideration as they continue to browse.

- Trade Valuations: Customers want the ability to not only get a trade-in estimate online but receive an actual offer. Allow for the customer to enter in vehicle information and upload videos/photos so you can offer an accurate trade in value remotely (based on the accuracy of the information provided). The solution should also support providing precise loan payoff amounts.

- Human Assist: Today’s consumers expect better interactions and immediate action from dealers. Make it easy for your customers to communicate with you. Help your shoppers find and buy the car they want. Basic integrated communication options such as built-in chat, messaging, email widgets and easy to use video technologies (e.g. video chat, FaceTime, Zoom, etc.) make it easy to virtually engage with your shoppers.

- Credit: If you go by the rule that you are more likely to lose a sale if the buying process is interrupted, then having the ability to complete a credit application, provide an instant credit decision (based on your credit tiers), and ultimately submit the app to a lender is critical to keeping the shopper engaged and satisfied.

- F&I Protection Products: F&I benefits from automotive digital retailing by moving F&I upstream in the buying process, creating opportunities to educate and pre-sell protection products specific to the customer and vehicle of choice. Automotive digital retailing also offers you the data-driven intelligence to present the most relevant products and the flexibility to determine what offers are made. Starting sales and finance at the same time creates efficiencies, improves closing ratios and increases PVR/CSI.

- Payment Quoting: Basic payment calculators establish unrealistic payment expectations and perpetuate stereotypes that lead to unwinds and defections. Your digital retailing solution should allow the shopper to view qualified purchase and lease payment options – matched to the consumers full credit profile and vehicle of choice. The two-way transparency is a trust multiplier and sales accelerator.

- Negotiation: One of the great things about digital retail transparency is that people perceive the price more accurately. Good automotive digital retailing dealerships will offer live virtual assistance to help shoppers understand the deal structure and figure out payments based on the vehicle selling price, qualified lender terms and the trade valuation. Functionality should allow the shopper to change terms post offer and recalculate the deal (e.g., change term, down, etc.) Finally, let the customer save their deals.

- F&I: Penny perfect pricing is nice but selling the car digitally involves getting to an out-the-door, fundable contract. Your digital finance technology should support hard credit-pulls and allow shoppers to select from a waterfall of qualified payment options – configured to include qualifying incentives, trade allowances, taxes, fees and dealer reserve – matched to your dealership’s lender programs.

- Digital Contracting: As part of the streamlined process to eliminate lengthy F&I waits, digital retailing should include remote or at dealership digital signing capabilities for all parties.

- Scheduling: Automotive digital retailing should include scheduling capabilities that enable consumers to schedule a test drive – remotely or at the dealership. Digital retailing allows shoppers to try before they buy. Post contracting – whether your buyer prefers the car delivered remotely or prefers to take possession at the dealership, a scheduled vehicle delivery option is important.

Future Proof Your Business

The way people want to buy cars has changed, and those changes are here to stay. Nearly two-thirds of car shoppers want to do more purchase steps online compared to the last time they purchased a vehicle, according to the 2020 Cox Automotive COVID-19 Consumer Impact Study.

Leading dealers are realizing the pain of not changing is greater than the pain of changing. It’s a balancing act between your customers’ expectations and your dealership’s success. If profits are determined by sales and sales are determined by your sales process, there’s little doubt that the greatest obstacle to success and customer satisfaction is making the process more convenient and accelerating transaction times.

Thriving dealers are devoting more time to thinking through and investing in the customer experience – creating value in the form of a superior ‘connected’ retail customer experience as their prime differentiator. Automotive digital retailing, including the right combination of technology, process change and people, will make the process easier and more efficient for both buyers and sellers.

Digital Retailing Benefits Dealers, Not Just Buyers

A good way to start answering a benefits question is first to accept some truths about your customer. Offering a digital path-to-purchase experience increases the likelihood a shopper will buy from your dealership – 85% more likely according to the Cox Automotive Digitization-of-End-to-End-Retailing-Study.

When it comes to choosing a dealership, 83% of consumers prefer a dealer that offers the ability to do one or more steps of the purchase process online, according to the Cox Automotive Car Buying Study. Consumer expectations have morphed the traditional car-buying process into a hybrid of online and offline interactions. You are likely to be disadvantaging yourself by not having a digital retailing strategy.

Paul Sansone, Jr, owner of Sansone Jr’s 66 Automall says it best, “If my handshake is better than your handshake, I’m going to win. And nowadays, the handshake happens online. That’s where you interact with your customer for the first time. Because that’s where they are. Digital retailing is a deal generation tool. It’s the start of the deal. You have to win the deal online before you can expect to win in the store.”

Not a Race to the Bottom

Before going any further, it is worth calling out some of the less often talked about revenue and profit generating potential of automotive digital retailing. Regardless of market conditions, dealers will always be challenged to grow volume and improve efficiencies. Digital retailing accomplishes both. Providing more car buying convenience for today’s shopper can pay off big:

- Automotive digital retailing tools helps you reach far beyond your primary marketing area.

- The sooner finance gets involved in the deal, the more profitably they can be structured. Deal transparency increases finance penetration.

- Dealers can command a price premium for the convenience of an amazing buying experience. This is an opportunity to earn gross regardless of market conditions.

- With much of the purchasing process occurring online, the showroom experience allows more time to educate and cultivate consumers – including learning about the additional services your dealership offers.

Sell The Car, Not the Appointment

Digital retailing done right should allow the customer to move down the funnel online by creating a clear path to purchase that gets them closer to the sale – start and stop where they want – and pick up where they left off when they get to the dealership.

Assuming your goal is to offer an end-to-end digital experience that drives transactions, your platform should include capabilities that empower customers to actually drive the transaction digitally – meaning every step in the process is digitized. The benefits of the simplified, streamlined process are many, and often, the benefits for customers and dealers tend to overlap.

-

1. Deal Generation v. Lead Generation

You are in the business of selling cars. The overwhelming majority of U.S. car buyers are payment buyers. The top frustration, cited by 42% of buyers in a recent CarGuru’s study is the lack of available payment information prior to contacting the dealer.

If most shoppers want to know what payment and finance terms they qualify for prior to making a buying decision – your digital retailing tools can make it easy and convenient for your shoppers to find the information they are looking for. The information transparency just makes sense, serving as both a trust builder and sales accelerant.

The more customers know, the more comfortable they are. The more comfortable they are, the more likely they are to buy. New digital finance technologies go well beyond traditional payment calculators. Let your lenders serve up their best offers and let the consumer make the choice.

By changing when and how the shopper is introduced to qualified payment information and dealership financing options, the combination of technology and data enable you and the buyer to come together much faster. The two-way transparency is a trust multiplier.

This requires an automotive digital retailing platform that supports hard-credit pulls and directly integrates with your desking/finance platform. You, the dealer, are in total control of how customers engage the F&I process – including all credit & finance filters and any numbers presented to the customer.

Calculated payments, matched to your lender programs, can also be configured to include qualifying incentives, trade allowances, taxes, fees….and dealer reserve. The result, your finance ready, remote buyers are fast tracked from your website to the showroom and thru F&I, increasing profits and customer satisfaction.

Note: Your automotive digital retailing platform should give you the flexibility to present your F&I pricing information online – in the same way you want it presented in-store. If they cannot or will not, you are not working with the right platform.

-

2. Dollars & Sense

A growing number of customers are looking for ways to speed up their time at the dealership by locking in their financing before they arrive in-store. In addition to reducing time at the dealership, there are other reasons more customers are willing to source their financing elsewhere:

- Consumers wanting more control over where and who and how they do business.

- New business models and digital finance technologies introduced by lenders and some of the disruptors.

- Much higher satisfaction scores among those consumers who secured direct financing outside the dealership.

Emerging trends like this translate to a higher proportion of customers showing up with financing arrangements already secured, reducing the opportunity to sell them value-added protection products and forfeiting F&I gross.

Fortunately, automotive digital retailing platforms create opportunities to insulate dealers from these risks by getting finance involved in the deal sooner. The deal transparency increases finance penetration- and the earlier finance gets involved in the deal, the more profitably they can be structured.

Digital retailing automotive technologies also create opportunities to maximize PVR by introducing customers to relevant F&I products throughout their buying experience – unlike the legacy practice of presenting all your F&I products after the purchase decision has been made and a contentious step in the process that many worn-out buyers understandably perceive as the dealer ‘selling’ add-ons and extras.

When customers are presented (educated) with ‘intelligent’ product suggestions and personalized offers at different points in their journey – they are much more likely to purchase.

Note: Your automotive digital retailing platform partner should enable you, the dealer, to configure precisely what F&I products and accessories are presented to your remote customers and present them at points in the process that are most statistically likely to drive conversion. If they cannot or will not, you don’t have the right platform.

-

3. Convenience

At the risk of stating the obvious, automotive digital retailing means your dealership is never closed. Your showroom is always open. Buyers can shop late at night, or early morning, or Sunday afternoon – the hours most businesses are not open.

And since you are ‘virtually’ never closed, your eCommerce solution should be powering an accelerated and streamlined digital path-to-purchase experience that drives transactions 24/7. Consumer expectations are forcing dealers to morph the traditional car-buying process into a hybrid of online and offline interactions.

The customer values convenience and speed. Dealers are searching for efficiencies and cost savings. Again, the benefits of digital retailing overlap between customer and dealer.

-

4. It’s About Time

As intended, automotive digital retialing tends to streamline and simplify the buying experience, making the process more efficient for both buyers and dealers. The efficiency benefit for the consumer translates to less time spent at the dealership and for the dealer, faster transaction times. In addition to the exceptional buying experience that fosters better customer interactions and motivates employees, the efficiencies for dealers accelerate sales throughput, help reduce costs and increase closing ratios.

-

5. Customer Satisfaction

The customer values the convenience and speed of a digital buying experience most. They also value the control, empowerment, and transparency that comes with driving the transaction in a pressure-free environment. In a marketplace where customer experience is edging out price and even product quality as a primary differentiator -selling the way the customer wants to buy can pay off big.

For dealers, profits are determined by sales and sales are determined by sales process. Providing an exceptional buying experience can command a price premium, creating incremental profit opportunities.

There is also a strong correlation between customer satisfaction and loyalty. Stand out and people will talk about you – boosting repeat and referral business. Future proof your business. Word of mouth travels fast.

Why Are Some Dealers Stalling on Automotive Digital Retailing?

Imagine someone walking into your dealership – perhaps a consultant or vendor – and suggesting that you are operating your dealership wrong. Immediately, you’d be fiercely defensive and most likely question their credibility, knowledge, and intentions. After all, your operations have been financially successful for years, even decades or generations.

That is how a lot of dealers feel about automotive digital retailing. To be fair, it is understandable that most dealers are slow to adopt new technologies that risk profitability and are reluctant to make serious changes to the retail status quo. In an industry that grew up believing you control the customer and, therefore, the deal – giving up any control and abandoning old-school thinking is extraordinarily difficult.

But unlike previous industry ‘shiny objects’, most would agree evolved customer shopping experiences and preferences – combined with the tremendous change experienced by the retail automotive industry in response to the pandemic, and emerging competitive business models like Carvana – car buyer expectations have been permanently altered and there’s no going back.

Today, your biggest competition is the status quo. So, what stands in the way for dealers?

Upsetting The Status Quo Has Its Challenges

There is a tendency in the industry to think of digital retailing as an opportunity most easily solved with the best available technology. There is little doubt that selecting the right technology is important – but the reality is – what dealers do with the technology is so much more important.

According to the 2021 eLEND Solutions Digital Retailing Study dealers reported their biggest barriers to a successful DR transformation are:

- People related challenges

- Technology deficits

- Required process/workflow changes

© 2021 LEND Solutions I www.elendsolutions.com

Digital Retailing Roadblocks & Speedbumps

People/staffing challenges (i.e. Missing leadership buy-in, employee/manager resistance to change, staffing mismatches, recruitment issues, etc.) are the #1 obstacle to a successful automotive digital retailing transformation.

A. Lack of Leadership

The most successful businesses in every industry build customer experiences around what the majority of customers want.

Dealers are scrambling to re-think business models and reinvent their retail experience due to the consumers overwhelming preference and expectation for an increasingly digital and transparent sales process. But that’s easier said than done. “Dealers are show-me-first” says Brian Benstock, VP/GM of Paragon Honda & Paragon Acura. “And today there’s not necessarily a clear path – even among the OEM’s”

Many talk about an Amazon or Apple-esque buying experience but those business models do not facilitate highly considered purchases or require complex deal structuring and financing. Those are unrealistic comparison expectations, but few would argue an evolution is long overdue. “We are not competing against each other but competing with the other experiences that customers have. We aren’t going back to the way things were” says Benstock.

Most dealers, including many of the larger dealer groups, aren’t equipped with the people, processes, or technology to deliver a more convenient, customer-first, digital path-to-purchase buying experience. So a sustainable transformation – one that inevitably will require a process, staffing, culture and technology evolution – requires a business model reinvention and leadership-led, top-to-bottom commitment.

It is a balancing act between the customers’ expectations and your dealership’s success. And because so many in our industry today only know what they learned pre-Internet, and certainly what they learned pre-pandemic, the required changes may be too much for many managers, and some dealers.

B. People/Staffing

Even during more normal times, dealers will say the biggest challenge in their variable departments is the costly talent gap – their inability to attract talented salespeople, especially Millennials and women. The hidden costs of high salesperson turnover, poor customer interactions and lack of commitment to the dealership, likely totals as much or more than any margin compression.

Creating ‘customer-first, digital first’ buying experiences can compound these challenges. How?

With more steps of the buying experience occurring away from the dealership, automotive digital retailing will inevitably change the traditional role of dealership salespeople (and F&I Managers and BDC agents).

Selling cars will always be a relationship business, but with the buyer having more control of the process and doing it remotely, the salesperson is no longer in the business of selling cars. They are in the business of helping customers buy the car.

In practice, this means focusing on the customer and making the relationship more important than the deal. It means salespeople will need to be less ‘transactionally’ motivated. Online car buyers need nurturing, not closing.

They will need unbiased guidance to navigate their many choices in a very complex transaction. What they don’t want or need is pressure and advice steered by pay plan considerations.

This shift requires a re-think of primarily commission-based pay plans but also the potential of creating staffing mismatches. Staffing mismatches occur when existing skill sets do not match well with re-defined job roles and responsibilities.

This creates recruitment opportunities but also the potential for recruitment issues – exacerbated by our economy and an industry that does not have the best reputation with consumers (especially Millennials) and a perceived gender bias that could be turning away half of the available talent pool.

2. Technology Roadblocks

For dealers (and OEM’s),, selecting and onboarding the right e-Commerce technology stack that enables a remote digital-path-to-purchase experience that doesn’t require a dealership visit – is among the most strategic decisions a modern auto retailer will make, not to mention a monumental endeavor. The two biggest challenges are:

- Finding the right technology to power the entire transaction online and

- Missing or problematic integrations.

A. Finding the Right Technology Platform

If the longer-term end goal for the retail automotive industry is true eCommerce, the industry will need to find technologies that simplify the process and create efficiencies for both buyers and dealers

It’s an exaggeration to say any current platform is truly end-to-end. For one thing, many states require a “wet signature” on sales contracts, meaning a physical signature. But different platforms have refined different parts of the sales experience to meet expectations of younger generations.

Today, most dealers allow customers to perform initial car purchasing steps remotely, but there is a significant drop off in ‘offered’ digital capabilities as the buyer moves closer to ‘the’ deal ( i.e., digital F&I). Some of the limitations are due to the dealers own resistance to digitize F&I. But the much more intricate and expensive challenge is building or finding the right technology that enables the entire transaction – including the complex deal structuring, financing, and contracting elements.

Consider for example, there are over 13,500 makes and models of new cars. Just new cars. And according to the AN 2020 Automotive eCommerce Report, there are hundreds of millions of make, model, trim, color option combinations.

To add to the complexity, the industry is regulated under strict federal and state advertising laws, franchise rules and brand compliance requirements, which makes it extremely difficult to calculate “to the penny” transactions on millions of cars that are legal in all 50 states and compliant with all franchise rules and brand guidelines.

B. Missing Or Problematic Integrations

In theory, with automotive digital retailing, the combination of technology and data should enable the dealer and the customer to come together much faster. The intended benefits are many, including greater than-before sales volumes, improved sales throughput, higher F&I product uptake, faster transaction times, and higher customer satisfaction. However, though the intent is there, commonly the functionality is not.

Some automotive digital retailing tools are primarily online but there are no in-store mobile or desking tools. Or just the opposite. Some DR providers offer an amazing showroom experience, but they don’t have a widget or an integration on the website that allows a seamless online to in-store transition.

Another challenge is the inconsistent API capabilities across the various automotive digital retailing solutions, CRM, DMS, FMS and Inventory platforms. In these situations, API’s exist but their ability to support the real-time, bi-directional information flow/exchange across platforms (pitch and catch) does not.

Missing or problematic online integrations across the various platforms involved in the sales and finance deal flow, create information disconnects, experience gaps and significant profit leaks. The disconnects create process redundancies and inefficiencies that are hugely frustrating to consumers and all but erase the intended benefits of DR for dealers.

3. Process/Workflow Roadblocks

The traditional way of selling cars was a process built by dealers for dealers. The idea that a customer could be almost as knowledgeable as the salesperson – and a traditionally manual, paper-based sales process would be digitized and facilitated away from the dealership – is more than most Owners & Dealer Principals ever imagined.

If you’re like most, you are invested in an industry you know and love, and in some way, it hurts to see it changing. But with a new normal, comes new opportunities…and everybody wants access to speed, convenience, and transparency – not just millennials.

Creating a Unified Car Buying Experience

If increasing customer satisfaction closely correlates with an increase in sales and profits”, a disconnected online to in-store buying experience filled with information gaps, process redundancies and wait times.

A customer-centric, technology-enabled sales process requires a holistic approach — viewing every piece of the process as connected and complementary. It means connecting the online experience and the showroom experience to create ONE unified buying experience. The transformation has proven to be easier said than done.

A. The Online To In-Store Transition

Automotive digital retailing done right should allow the customer to move themselves down-funnel online by creating a clear path to purchase that gets them closer to the sale – and pick up where they left off when they get to the dealership.

But fully digitizing the transaction can only happen if these online retail tools are connected with the platforms involved in the dealers’ sales and finance deal flow. Unfortunately, it is common for many automotive digital retailing tools to stand-alone and not be well integrated with the dealers CRM, DMS, Desking and Finance Platforms.

Beyond individual vendor API capabilities – seamless, secure data exchanges between platforms can only happen if vendors choose to cooperate. Service providers would have to move to an open integration model and vendors would have to choose to collaborate for the transaction to be fully digitized. And for (3) reasons, that cooperation is unlikely:

- Vendors more interested in protecting the status quo

- Vendor competition makes cooperation unlikely

- Vendor propensity to ‘own the space” and hoard the information

- Vendor resistance to invest/support open API technologies

Bottom line, it would be difficult for Dealers to evolve if their vendor ‘partners’ don’t also evolve.

B. Poor Customer Interactions

As the auto industry evolves from lead generation to a transaction-based business model, leading dealers are moving away from lead capture strategies and using automotive digital retailing solutions and real time, advanced chat, messaging, and video solutions to accelerate deal creation. What should come next is for in-store processes to be aligned with expectations established online – but most dealers aren’t ready for what comes next.

Salespeople not having access/visibility to the information provided or the steps completed online. – and other process/workflow gaps – leave automotive digital retailing customers treated no different than a cold walk-in. So the remote customer who has spent hours completing many steps of the transaction prior to the dealership visit, thinking they would be saving time at the dealership, has to start over!

C. Different Buyer Preferences Require Flexibility

Thinking about what the customer wants to do, not what you want them to do – means that a unified sales process needs to be flexible enough to meet all your customers’ needs. Buyers are always going to prefer to shop and transact on their own terms, including these three main buying scenarios:

- Traditional: This customer wants to do everything in person at the dealership.

- Hybrid: This shopper wants the best of both worlds. They complete the steps of the car buying process they enjoy in person at the dealership, but they would rather complete some tasks online.

- Digital: This customer would prefer to complete the entire car buying process remotely, without ever physically stepping foot into the dealership.

D. Automotive Digital Retailing Success Is Not Easily Replicated and Scaled

Every dealership is responsible for developing the processes and workflows that work best for their store. What works for one dealership isn’t necessarily going to work for the next. Every store has their own unique sales and service propositions; their own culture; their unique trading area demographics, and franchise rules and brand requirements.

Any automotive digital retailing strategy must be tailored and tweaked in a way to best fits the dealership where it’s implemented – it likely won’t be the exact same process or experience for any two stores, even in the same dealer group!

Digital First, Customer First, Credit First

Transforming the transaction is not limited to offering digital buying capabilities for remote buyers. If profits are determined by sales and sales are determined by sales process, there’s little doubt that the greatest obstacle to success and customer satisfaction is the time it takes to complete the deal structuring and F&I portions of the car-buying process. Based on research, the biggest opportunities to improve the Sales & Finance process in-store are:

- Creating greater information flow between the Sales and Finance departments

- Improving the speed and quality of the customer’s transition from Sales to F&I

- Reducing the time the customer spends in F&I

As part of a digital first, customer-first buying experience, starting sales and finance together at the same time – can address these opportunities.

Credit First vs. Credit Last

Traditionally, most dealerships have by design, operationally separated Sales and F&I – dictating a process wherein F&I is not engaged until after they have four-squared the deal. In fact, in an eLEND Solutions survey of U.S. based dealers, 57% of dealership respondents reported that Sales closes the ‘deal’ without credit pre-qualification or pre-approval. In a traditional process built by dealers for dealers, credit and finance conversations are saved for the F&I professionals to work out in the box.

This is a ‘credit last’ path to purchase. For many dealers, controlling the customer and the deal has made them financially successful. Dealers can and should and will run their businesses the way they want, but there is an opportunity to reverse-engineer an old-school workflow that increases closing ratios, PVR and customer satisfaction – while reducing the F&I time delay.

Risk Free Buying & Selling

According to a Cox Automotive Study, 90% of US buyers are payment buyers. Meaning for today’s car shoppers, deal transparency is just as important as price transparency. For dealers, ‘transparency’ translates to providing an upfront and honest transaction. Changing stereotypes and transforming the transaction starts with presenting real numbers. Real pricing. Real payments, rates and terms. Real trade equity.

Factors that affect accurate payment, rate and term quoting:

- Credit, Ability and Stability Eligibility

- Vehicle Selection (new/used)

- Type of Financing (lease/loan)

- Trade-in Equity (+/-)

Soft-pull credit solutions, available from all credit repositories and most credit resellers, do not require a customer’s DOB or SS#, and do not affect the customer’s credit score. Requiring only the customers’ name and address, soft-pulls provide an upfront snapshot of the customers’ credit profile, and insights into their buying power before you start working the deal.

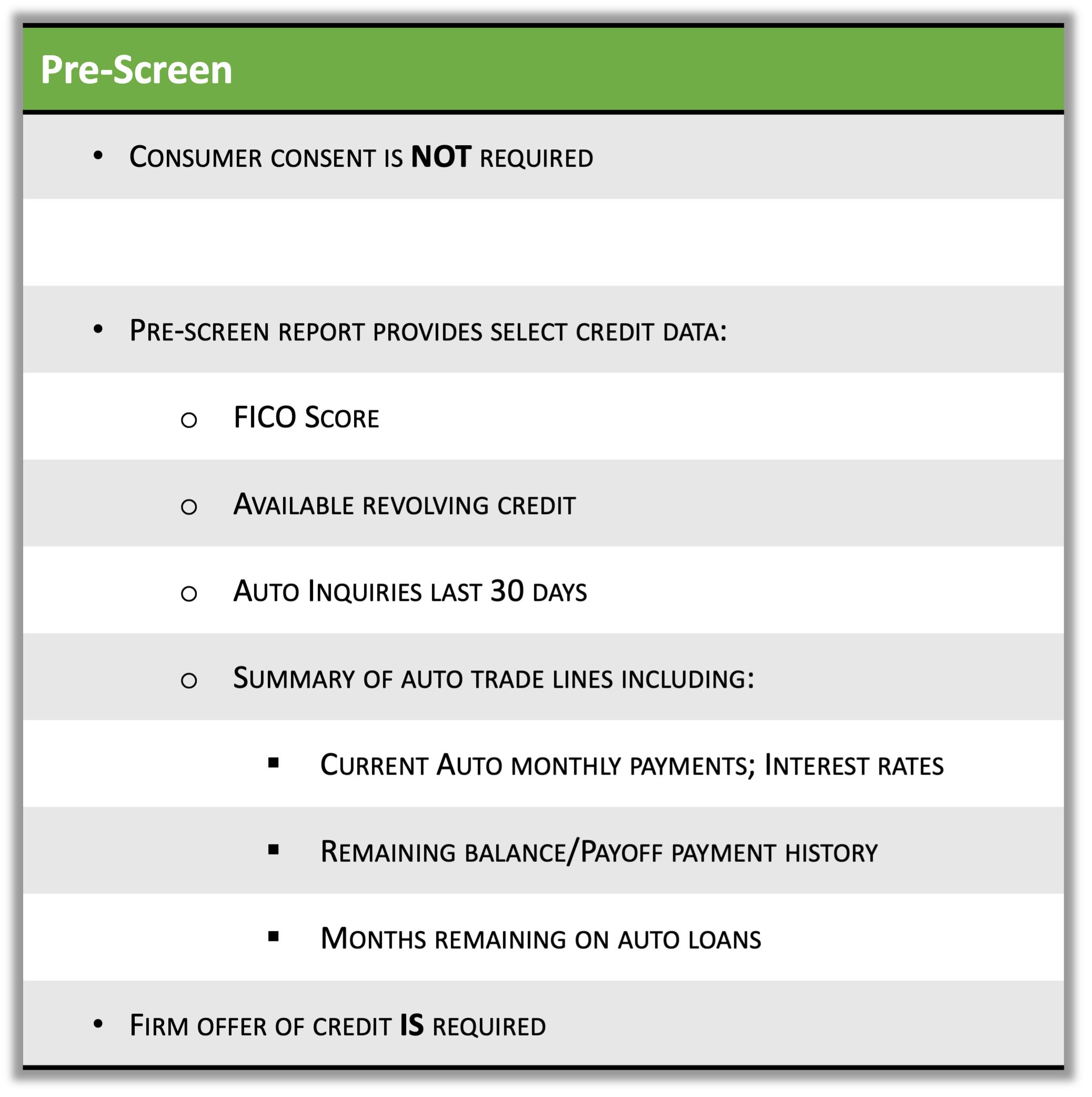

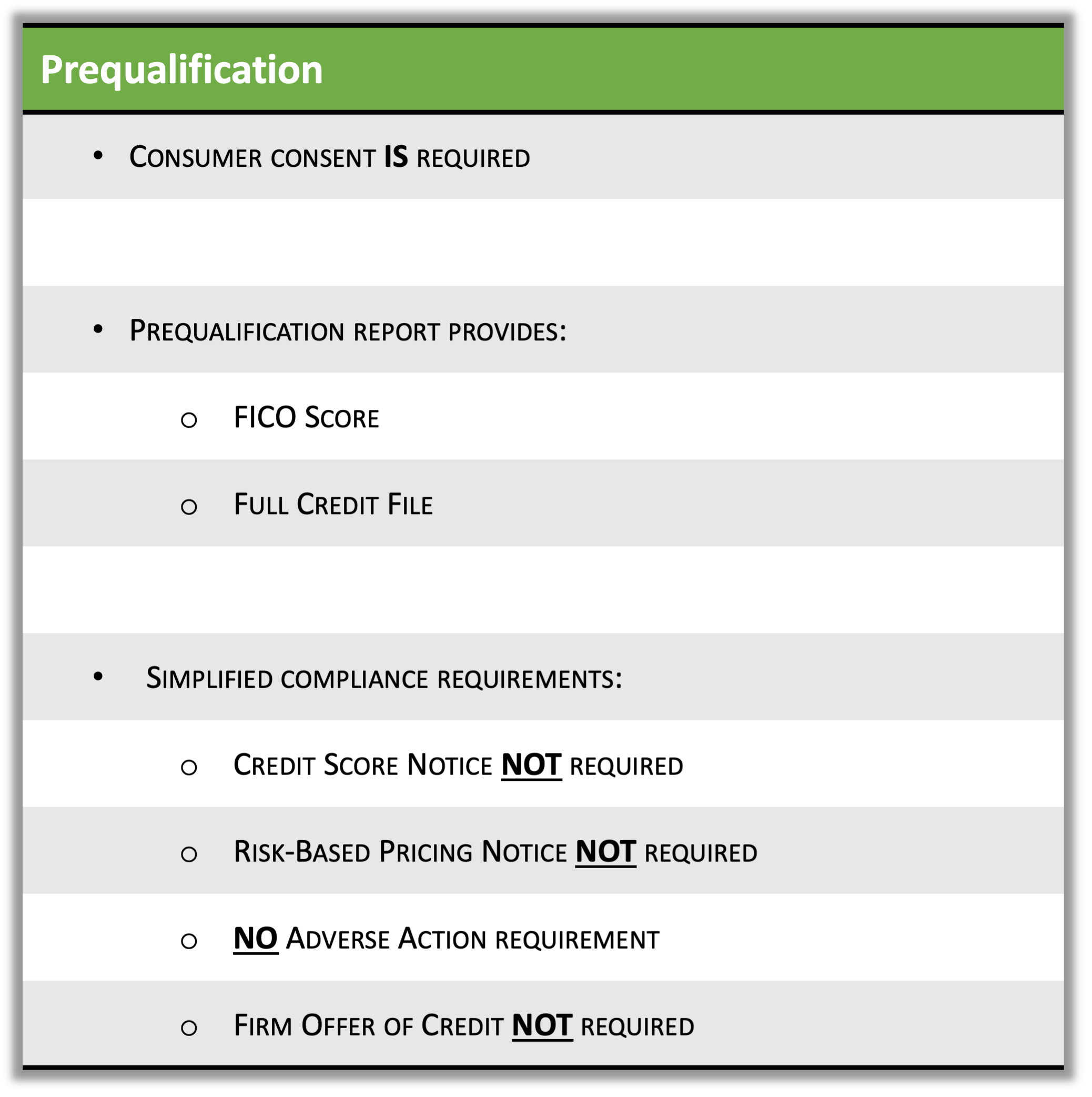

There are (2) Soft-pull types: Dealer initiated pre-screens and consumer consented pre-qualifications. Both provide insights into the customer’s credit worthiness and start the deal right, but they are not the same. It is important to understand the differences and protect your store from potential compliance and security risks.

Difference Between Pre-Screen & Pre-Qualification Solutions

Credit soft-pulls are not a replacement for a hard inquiry and the report is not shared with the lender but unless you have a 100% closing ratio, the soft-pull will save time and monthly credit report expenses by eliminating the FICO surcharge and the simplified compliance requirements.

Soft-pulls also allow you to work deals in stealth mode, eliminating trigger leads to your competition.

Note: For even more buyer and seller convenience, advanced Identity verification solutions can instantly capture, digitize and authenticate the scanned driver license data in one simple step that takes seconds – and convert the scan into a pre-screen or consumer consented pre-qualification. These solutions work for both in-store and remote shoppers/buyers.

Both credit soft-pull and identity verification solutions accelerate the transaction while also minimizing frictions and protecting your dealership from compliance and identify fraud risks

Sell the Way Your Customer Wants to Buy

As part of a credit-first buying experience, introducing credit-qualified financing options early in the sales process enables you to easily move your customer’s focus from the price to monthly payments that they can afford. If you provide details on different financing options and the required down payment/monthly payment combinations, the discounting will no longer be part of the conversation.

By overlapping the sales and finance functions, the faster and more profitably the deal can be structured. Sales working with finance can re-work the four square (including repayment terms, required down payment and/or dealer participation) so that discounting is not required to satisfy your buyers goals. If the customer wants a $450 payment, find the car and terms that makes that happen (with a VSC and/or GAP included if you can).

Additionally, customers can be comforted and reassured that they are approved before getting to the finance office. Quoting accurate, qualified numbers is also a trust multiplier, helping you and the customer come together much faster – and preventing unavoidable conflict when unrealistic payment expectations can not be honored in the finance office. The upfront ‘transparency’ means fewer rehashes and unwinds, saving time in the box, allowing finance to sell more F&I products and handle more deliveries.

Transforming the Transaction

Both ‘credit first’ and ‘credit last’ approaches have merits but your ability to meet the customers’ experience expectations starts with ‘credit first’.

In other buying experiences that include expensive, highly considered purchases or require complex deal structuring or financing – other than retail automotive – shoppers are encouraged to engage in the process after getting pre-approved or even pre-arranging their financing. The advice seems less predatory, more customer benefit focused, and reduces the time spent at the dealership. It’s everything today’s car shopper is asking for.

Introducing finance prior to working the deal shouldn’t be considered a speed bump on the road to the sale. Every customer has a stereotype about the car-buying experience. Quoting accurate, qualified numbers is a trust multiplier, helping you and the customer come together much faster – and preventing unavoidable conflict when unrealistic payment expectations can be honored in the finance office.

Everybody wants to be more efficient and save time, not just consumers. Prequalification and Pre-screen solutions both accelerate engagement and conversions Evolve at your own pace but the transformed transaction improves closing ratios, increases PVR/CSI, and creates efficiencies leading to faster transaction times by putting your buyer in the right car and right deal structure right away.