Connected Retailing Solutions

Your dealership. Your way. Powered by middleware.

- Faster, more efficient deal flows.

- Seamless, trust-building customer experiences.

- Full control and vendor independence.

for Connected

Retailing

Connected Solutions for Connected Retailing

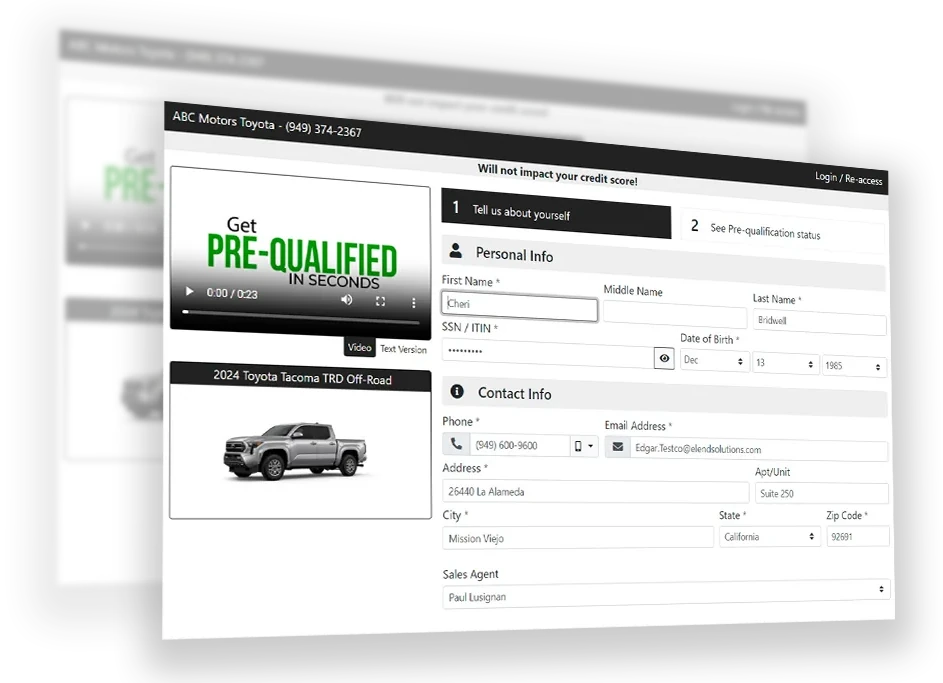

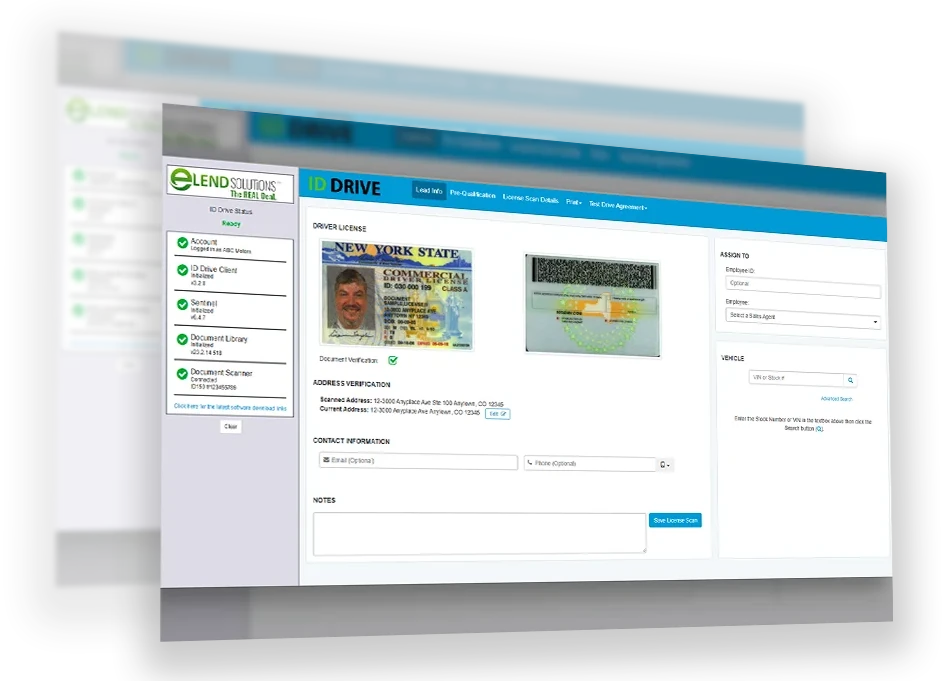

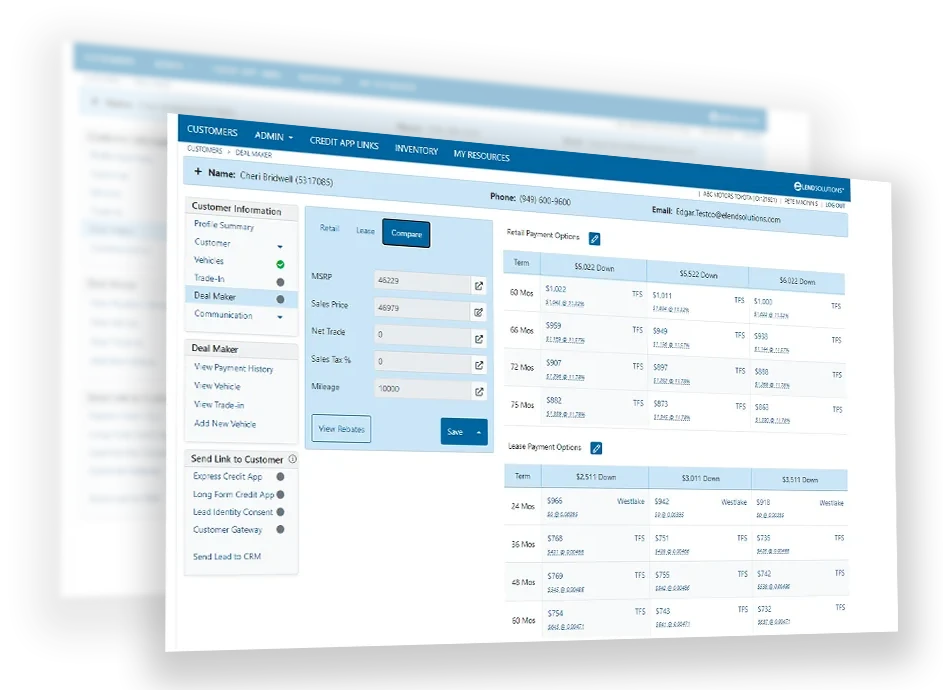

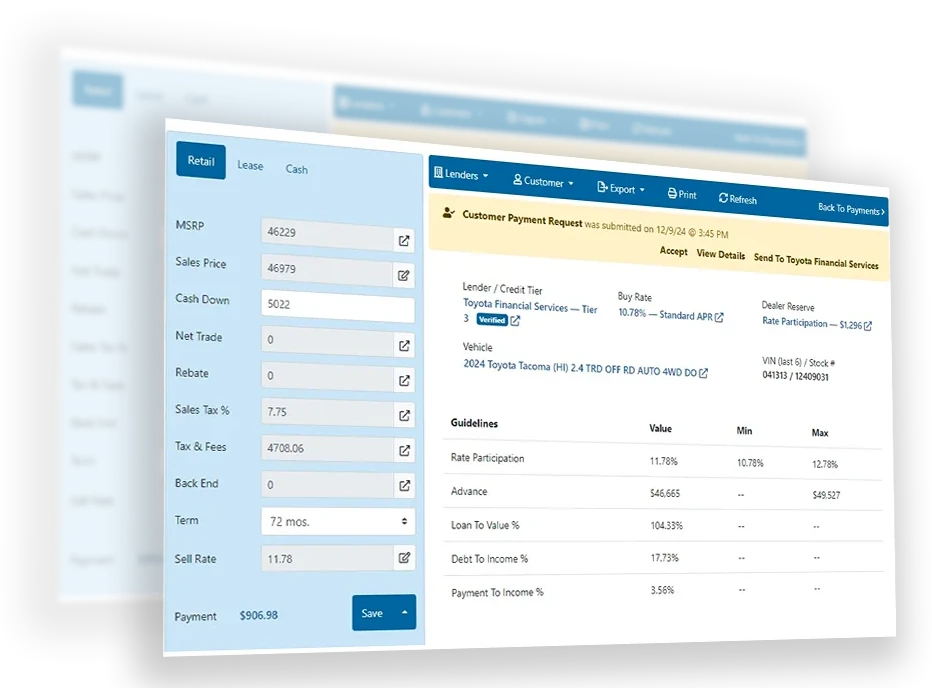

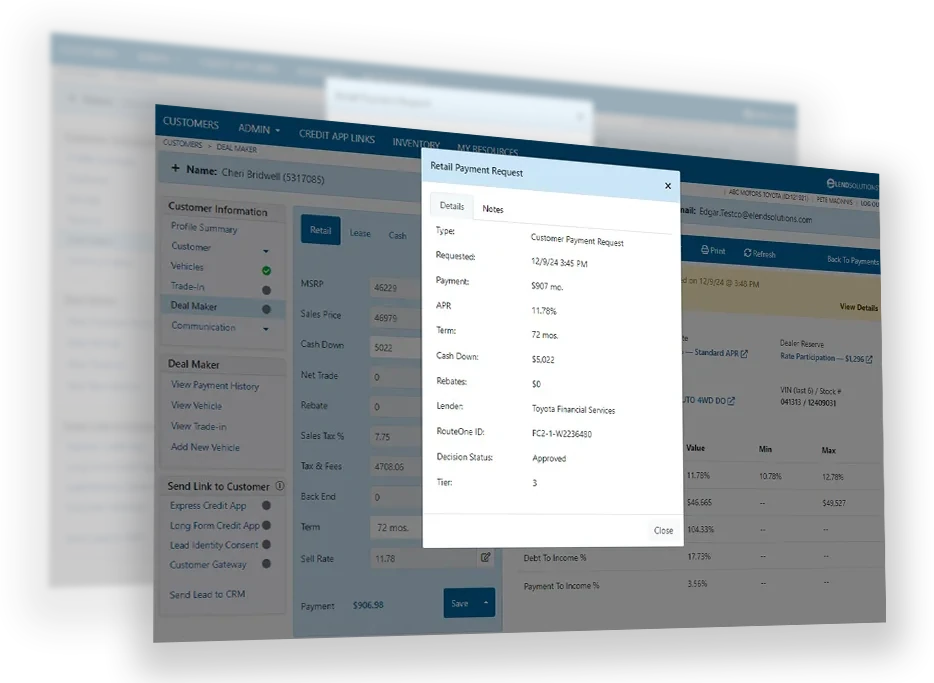

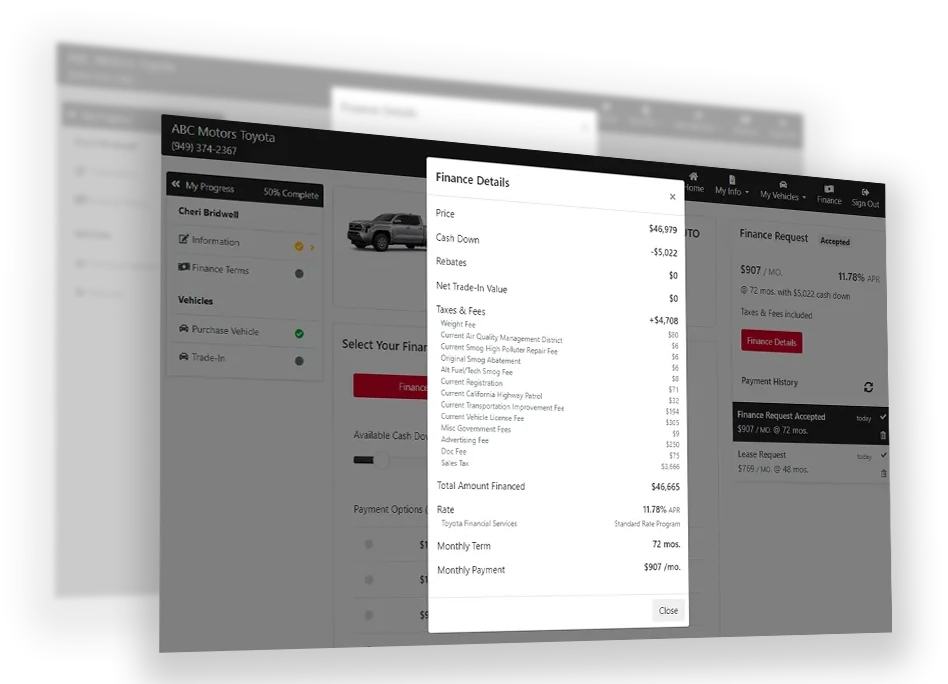

Our API enabled middleware solution changes when and how the shopper is introduced to qualified payment information and dealership financing options- accelerating the transaction and enabling true end-to-end connected retailing.

Why Choose eLEND Solutions?

Easy Integration

Our vendor neutral platform offers no-charge, bi-lateral API’s with your core platforms and most DR platforms without switching costs or forcing you into restrictive contracts or relationships with specific vendors.

Accuracy

Advanced credit filtering and calculation logic provides every customer with personalized, fundable lease and finance calculations for all year, make, model, trim, option combinations and all credit tiers - for all buying scenarios. Prior to the F&I handoff.

Flexibility

Our solutions offer almost endless configuration options - giving you the flexibility to determine what advantages and workflows work best for your strategy, your brand and your customers.

Advantages & Benefits of

Connected Retailing

How Our Middleware for

Connected Retailing Works